Managing payroll is an important task for every business. Payroll must be correct and timely to ensure staff are paid the right amount. But, payroll isn’t just about salaries. It also involves calculating Professional Tax, PF, and ESI Calculation. If these calculations are wrong, it can lead to problems like legal issues or losing money. So, using tools to handle tax calculation, PF, and ESI Calculation can make everything easier and more accurate. This reduces mistakes and helps businesses avoid unnecessary risks.

What is Professional Tax?

Professional Tax (PT) is a tax that staff pay based on their job or profession. It is different in every state in India, meaning rates and rules can change from one state to another. Employers need to deduct Professional Tax from their employees’ salaries and send it to the government on time. If these deductions are not made correctly, businesses could face fines. So, it’s vital to understand how PT works and use the correct tax calculation tools to make sure it’s done right.

HR Skills are important for managing payroll well. HR staff must know the local PT rates, as they can change from time to time. Some states charge higher rates for higher income employees, while others have fixed rates for everyone. Because the rules change, businesses must keep track of the right rates to avoid mistakes.

Avoid Tax Calculation Errors with Advanced Tools:

Calculating taxes, PF, and ESI Calculation by hand can be hard, especially when there are many employees. Even a small mistake in calculations can cause big problems like over or under deductions. If this happens, employees won’t get the right amount of benefits, or the business could face legal issues. So, using payroll tools is a smart choice to avoid such mistakes.

These tools automatically calculate taxes, PF, and ESI Calculation for businesses. This makes sure all deductions are correct. Because these tools are up to date with the latest rules, businesses don’t need to worry about missing changes in tax laws. So, using these tools helps businesses follow the laws, reducing the chance of penalties.

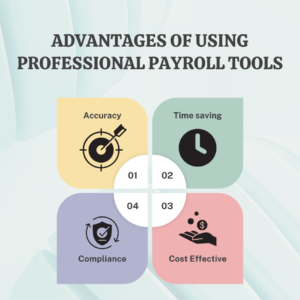

Advantages of Using Professional Payroll Tools:

- Accuracy: Payroll tools help businesses calculate taxes, PF, and ESI Calculation accurately. These tools are made for payroll tasks, so they handle all the details. As a result, businesses don’t need to worry about mistakes in calculations, and employees are always paid the right amount.

- Time saving: Managing payroll manually takes a lot of time. But, using payroll tools speeds up the process. These tools do all the calculations quickly, giving HR teams more time to focus on other major tasks. So, payroll is processed faster, and employees are paid on time.

- Compliance: Payroll tools are updated regularly to match the latest tax laws. So, businesses don’t have to track changes themselves. This makes sure all deductions are correct, helping companies stay compliant and avoid fines.

- Cost Effective: At first, payroll tools might seem expensive. But, in the long run, they save businesses money. Because the tools help prevent mistakes in tax calculation, businesses can avoid paying fines for wrong deductions. So, these tools help save both time and money.

How Professional Payroll Tools Mitigate Compliance Risks:

When payroll is handled manually, mistakes are more likely to happen. These mistakes can lead to issues like incorrect deductions for Professional Tax, PF, or ESI Calculation. But, using payroll tools can solve these problems. These tools make sure every deduction is correct and follows the law.

Payroll tools also create reports for all tax calculations, ESI Calculation, and other deductions. If tax authorities need to check, these reports can show that the business is following the rules. This way, businesses don’t need to worry about proving their compliance.

Payroll tools also send reminders for important dates like tax payments, PF submissions, and ESI contributions. These tools help businesses keep track of deadlines, so they don’t miss any important dates. This helps companies stay on top of their duties and avoid late fees

Furthermore, payroll tools help businesses manage employee information. This includes things like salary details, HR Qualifications, and contribution rates. This ensures that everything stays correct and up to date. Manual payroll systems are harder to manage and can lead to errors in this data.

Conclusion:

using professional tax calculators, Professional Tax, and ESI Calculation tools is essential for businesses to keep payroll accurate and compliant. These tools save time and reduce errors, preventing legal problems. By using payroll tools, businesses can ensure all deductions are correct and employees are paid on time. If you want to improve your payroll process, IMHR Academy offers reliable tools that manage taxes, PF, and ESI Calculation with ease. So, choosing IMHR Academy will help make sure your payroll is correct, compliant, and stress free, allowing your business to focus on growth.